We Retired Early and We Are Not Planning To Leave Money For Our Kids

Picture this: You've worked hard, saved diligently, and finally achieved the dream of early retirement. The world is your oyster, and you're ready to savor every moment of your hard-earned freedom. But there's a catch – you've decided not to leave an inheritance for your children. 😱

Shocking? Perhaps. Controversial? Absolutely. Yet, for an increasing number of early retirees, this unconventional approach to family finances is becoming a deliberate choice. We're one such couple, and our decision has sparked both curiosity and criticism. But before you judge, let's delve into the why behind our choice and how it's shaping our relationships, our children's futures, and our own golden years.

In this post, we'll take you on a journey through our early retirement story, unveiling our unique financial philosophy. We'll explore the reasons behind our decision not to leave money for our kids, and how we're supporting them in other meaningful ways. We'll also tackle the thorny issue of managing family expectations and share our strategies for planning our later years. Buckle up – it's going to be an eye-opening ride! 🎢💰👨👩👧👦

Our Early Retirement Journey

Achieving financial independence

Financial independence was the cornerstone of our early retirement journey. We implemented a multi-faceted approach to reach this milestone:

Aggressive savings strategy

Diversified investment portfolio

Frugal lifestyle choices

Side hustles for additional income

Our dedication to saving allowed us to accumulate wealth quickly. We consistently saved 50-70% of our income, far exceeding the conventional advice of 10-20%. This aggressive savings rate was crucial in accelerating our path to financial independence.

Making the decision to retire early

Once we achieved financial independence, we carefully evaluated our decision to retire early. Key factors we considered included:

Financial sustainability

Personal fulfillment

Health and well-being

Family dynamics

After thorough analysis and discussions, we determined that early retirement aligned with our values and long-term goals.

Adjusting to retired life

Transitioning to retired life presented both challenges and opportunities. We found that:

Creating a structured routine was essential

Pursuing passion projects kept us engaged

Volunteering added purpose to our days

Maintaining social connections prevented isolation

Adapting to this new lifestyle took time, but ultimately led to a more fulfilling and balanced life. With our newfound freedom, we've been able to focus on personal growth, relationships, and experiences that truly matter to us.

Our Financial Philosophy

A. Living below our means

Living below our means has been the cornerstone of our financial philosophy. This approach involves spending less than we earn, allowing us to save and invest the difference. We've adopted several strategies to achieve this:

Budgeting: Creating and sticking to a detailed monthly budget

Minimizing fixed expenses: Opting for a smaller home and used vehicles

Cutting unnecessary costs: Reducing dining out and entertainment expenses

DIY approach: Learning to handle home repairs and maintenance ourselves

B. Investing wisely

Our investment strategy focuses on long-term growth and diversification. We've implemented the following tactics:

C. Prioritizing experiences over material possessions

We believe that experiences bring more lasting happiness than material possessions. This mindset has led us to:

Allocate more funds for travel and family activities

Limit purchases of luxury items or status symbols

Focus on creating memories rather than accumulating things

D. Maintaining financial security in retirement

To ensure our financial security throughout retirement, we've implemented these strategies:

Building a robust emergency fund

Developing multiple income streams (e.g., rental properties, part-time consulting)

Regularly reassessing our financial plan and adjusting as needed

Staying informed about market trends and economic changes

By adhering to these principles, we've not only achieved early retirement but also maintained a fulfilling lifestyle without compromising our future financial stability. This approach has allowed us to focus on personal growth and meaningful experiences rather than material wealth accumulation.

Reasons for Not Leaving Money to Our Kids

A. Encouraging self-reliance and independence

Our decision to not leave money for our kids stems from a desire to foster their independence and self-reliance. We believe that by not providing a financial safety net, our children will be motivated to develop crucial life skills and a strong work ethic. This approach encourages them to:

Take ownership of their financial future

Develop problem-solving abilities

Learn to budget and manage money effectively

Pursue their own career paths and passions

B. Avoiding potential family conflicts

Inheritance often leads to family disputes and strained relationships. By choosing not to leave money behind, we aim to:

Prevent sibling rivalries over asset distribution

Eliminate feelings of entitlement

Maintain family harmony in our absence

C. Enjoying our hard-earned savings

After years of diligent saving and careful financial planning, we believe it's important to enjoy the fruits of our labor.

This is a subtitle for your new post

D. Teaching valuable life lessons

By not leaving an inheritance, we're imparting important life lessons to our children:

The value of hard work and perseverance

The importance of financial planning and responsibility

The ability to create their own success and wealth

The satisfaction of achieving goals independently

This approach aligns with our belief that true wealth comes from personal growth, experiences, and the ability to navigate life's challenges independently.

How We're Supporting Our Kids Instead

A. Providing quality education

Investing in our children's education remains a top priority despite our early retirement. We believe that a solid educational foundation is the best gift we can offer. Here's how we're ensuring our kids receive quality education:

Prioritizing school choice and research

Allocating funds for tutoring and enrichment programs

Encouraging extracurricular activities to develop well-rounded skills

B. Teaching financial literacy

We believe that imparting financial wisdom is crucial for our children's future success. Our approach includes:

- Regular discussions about budgeting and saving

- Introducing investment concepts at an early age

- Encouraging part-time jobs to learn the value of money

C. Encouraging entrepreneurship

Fostering an entrepreneurial spirit can lead to long-term financial independence. We support our kids' entrepreneurial endeavors by:

- Helping them identify potential business opportunities

- Guiding them through the process of creating business plans

- Providing small "seed investments" for their ventures

D. Offering emotional support and guidance

While financial support is important, we recognize that emotional support is equally crucial. We prioritize:

- Open communication about life choices and challenges

- Regular family meetings to discuss goals and aspirations

- Being present for important milestones and decisions

By focusing on these areas, we aim to equip our children with the tools and confidence they need to build their own successful futures. This approach aligns with our belief in empowering them rather than creating financial dependence.

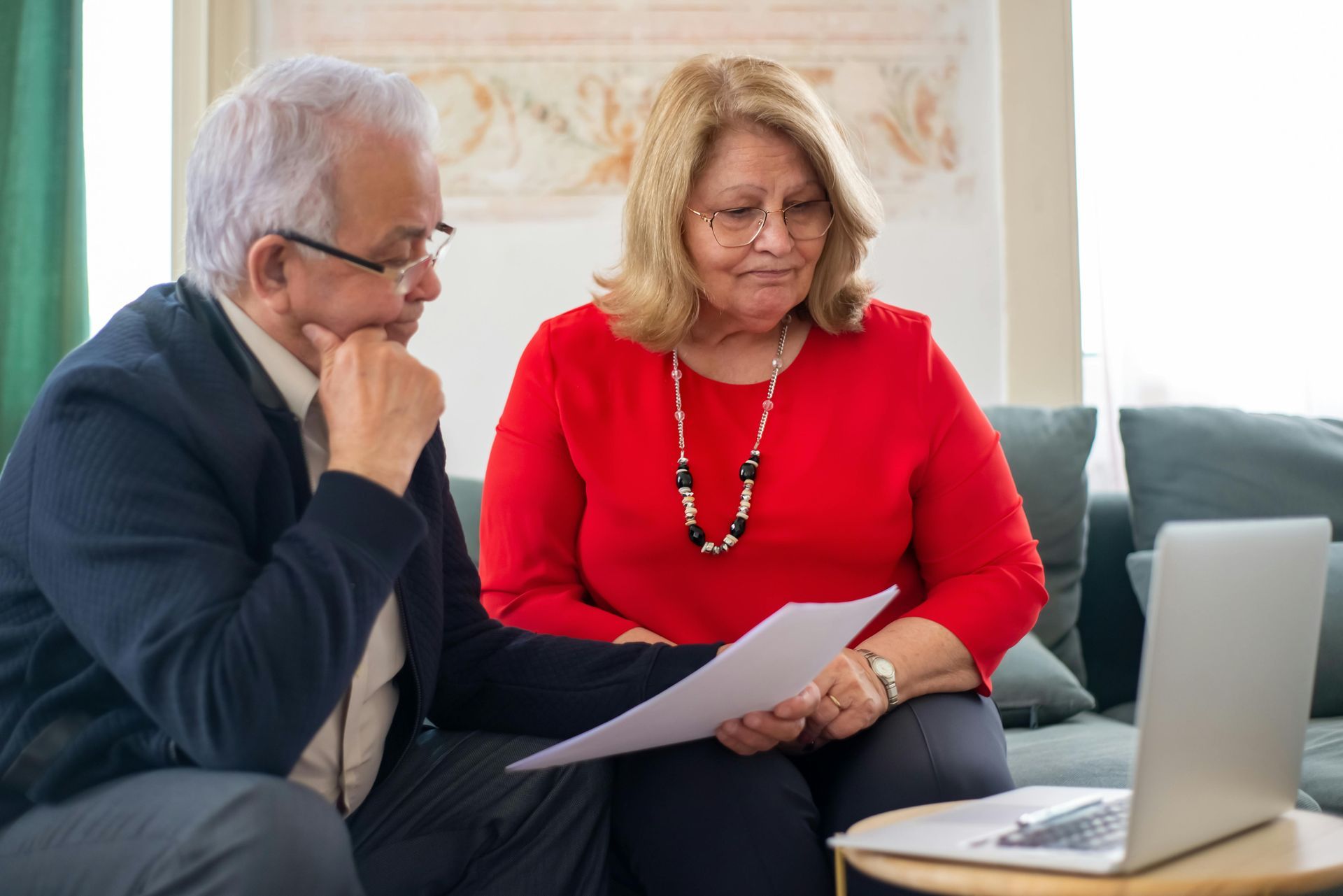

Communicating our decision openly

Open and honest communication is crucial when managing family expectations about inheritance. We've found that addressing the topic directly with our children and extended family members has been the best approach. Here's how we've handled these conversations:

- Set up family meetings to discuss our financial plans

- Explain our reasoning behind the decision

- Encourage questions and provide thoughtful answers

- Share our alternative support strategies

Addressing potential concerns

It's natural for family members to have concerns about our decision not to leave an inheritance. We've encountered various reactions and have developed strategies to address them:

This is a subtitle for your new post

Communicating our decision openly

Open and honest communication is crucial when managing family expectations about inheritance. We've found that addressing the topic directly with our children and extended family members has been the best approach. Here's how we've handled these conversations:

- Set up family meetings to discuss our financial plans

- Explain our reasoning behind the decision

- Encourage questions and provide thoughtful answers

- Share our alternative support strategies

Addressing potential concerns

It's natural for family members to have concerns about our decision not to leave an inheritance.

Setting clear boundaries

Establishing and maintaining boundaries is essential to prevent misunderstandings and manage expectations. We've implemented the following practices:

- Regularly reinforce our decision through consistent messaging

- Avoid making financial promises we can't keep

- Encourage financial independence among our children

- Redirect inheritance-related requests to discussions about personal growth and development

By being transparent about our choices and consistently reinforcing our boundaries, we've been able to navigate this potentially sensitive topic with our family. This approach has helped maintain healthy relationships while staying true to our financial philosophy and retirement goals.:

Planning for Our Later Years

Healthcare considerations

As retirees, we understand the importance of prioritizing healthcare in our later years. Here are key considerations:

- Regular check-ups and preventive care

- Comprehensive health insurance coverage

- Emergency fund for unexpected medical expenses

- Exploring supplemental insurance options

Long-term care options

Planning for long-term care is crucial to maintain our independence and quality of life. We've researched various options:

- Aging in place with home modifications

- In-home care services

- Assisted living facilities

- Continuing care retirement communities

We're currently leaning towards a combination of aging in place and in-home care services, but we remain open to adjusting our plans as our needs evolve.

Estate planning without inheritance

Despite our decision not to leave an inheritance, proper estate planning remains essential. We've focused on:

- Creating living wills and advance directives

- Designating power of attorney for healthcare and finances

- Organizing important documents and digital assets

- Discussing end-of-life preferences with our children

By addressing these aspects, we ensure our wishes are respected and minimize potential conflicts. As we move forward, we'll continue to reassess and adjust our plans to accommodate changing circumstances and maintain our financial independence throughout our retirement years.

B. With extended family

Extended family reactions have been mixed, ranging from understanding to skepticism. This decision has:

- Sparked debates about generational wealth

- Led to more transparent discussions about money within the family

- Sometimes created tension, particularly with more traditional family members

C. With friends and community

In our social circles, our choice has:

- Inspired some friends to reconsider their own financial plans

- Led to engaging discussions about the purpose of wealth and legacy

- Occasionally resulted in judgment or misunderstanding

Overall, while our decision has created some challenges, it has largely led to more honest, open relationships centered on shared values rather than financial expectations. This transparency has strengthened many of our connections, allowing for more authentic interactions and mutual understanding.

Retiring early and choosing not to leave an inheritance for our children has been a journey filled with careful consideration and personal growth. Throughout this process, we've learned the importance of financial independence, the value of experiences over material possessions, and the power of teaching our children self-reliance.

While our decision may not be conventional, we believe it's the right choice for our family. By supporting our children in non-monetary ways, managing family expectations, and planning for our later years, we're creating a legacy of financial wisdom and personal responsibility. Ultimately, our goal is to empower our children to forge their own paths and find fulfillment in their own achievements, while we enjoy the fruits of our labor and continue to nurture our relationships with loved ones.